How to Reduce Overdue in a Business

In this if we are making View the full answer. Hold events to reward your customers for being good clients.

Dashboard Templates Ceo Dashboard Financial Dashboard Kpi Dashboard Dashboard Template

On starting a business with someone you must make sure you stamp your invoices with the date that payment is due to you.

. Create a well-defined credit policy. Its reasonable to expect that some customers may simply need extra time to pay. 30 days past due send an e-mail and mail a.

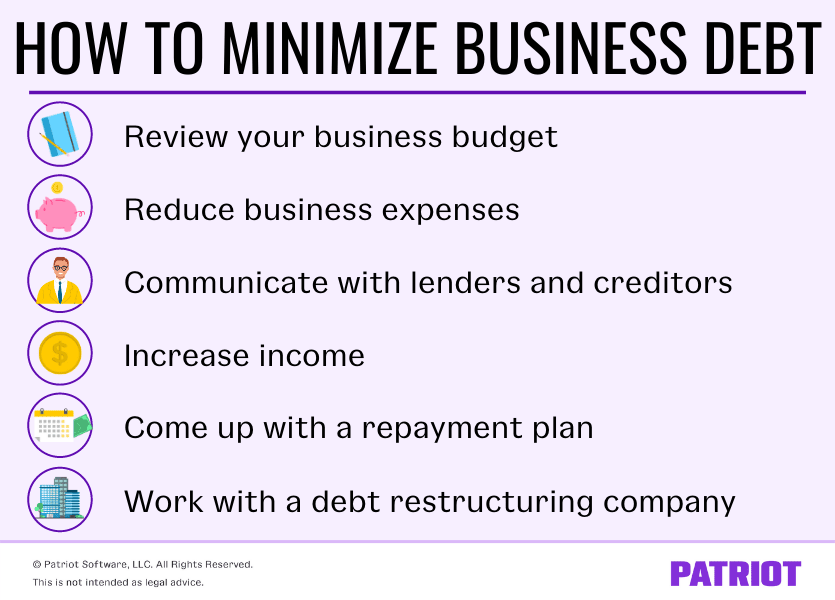

So when it comes to minimizing debt where do you start. However it is possible to spend less time worrying about getting paid and more time adding value to your business. Offer discounts for early payment and add interest to late payments.

Develop friendships with the companys leadership. Now divide ARs by daily sales 50m divided by 11m 45 days sales outstanding. Present clear payment terms.

To reduce the overdue in business companies or businesses need to do-Prior to payment deadlines make phone calls or contact consumers. Offer discounts for early payments. For example many companies offer early payment terms such as 2 percent off for payment of the bill within 10 days of the invoice date.

For them create a written late-payment schedule. Your business budget is an important tool for your business. If you havent received payment call customers as soon as possible before or on the invoice due date.

Dont make credit management subordinate to sales. Use these 13 ideas to reduce your business debt. Do a background check of your customers.

Heres an easy way to save money. The reports show historical payment data and a rating that demonstrates how likely they are to pay their bills. While you dont want to destroy any future or existing business relationships by laying down strict payment terms you must enforce these.

Automate the chasing process. And of course for those customers that run late in their payments interest will be added to their late payments. Get rid of the paper to cut down on the clutter and save.

How can overdue debts be prevented from wholesalers. Use written late-payment agreements. For most industries thats a pretty good number.

Generally overdue in business is caused by non recovery of debt from the debtor at proper interval of time. Dont just be familiar with your numbersknow them. When you pay these suppliers on time you contribute to improved cash flow for your company.

Start calling customers and trying to collect the day after a payment is due. The following are the 5 steps that one must follow to avoid overdue. Using good accounting software is essential for every business.

If you accept 100 payment upfront then theres no risk of overdue invoices or clients holding payments hostage. First it tracks all your. First step in preventing overdue accounts is to analyze the potential customers credit report before you extend them credit.

Offer discounts for early payment and add interest to late payments. So its much more Important to know how to reduce overdue. First things first get to know your numbers by assessing your small business budget.

Do a credit check. Should use the most recent Republican proposal the Toomey Plan to raise revenues to reduce the countrys debt. Accept full payment upfrontno due date hassle.

However to see what carrying this level of ARs is costing you multiply 50m by your firms cost of capital say 12 6m per year or 500K per month cost of financing receivables. It can help you track progress project cash flow and reduce risks. The Toomey Plan will dramatically reduce the deductions and any credits wealthier taxpayers can claim to reduce their tax liability.

Communicate and communicate some more. Make it easy for them to pay. Stephen Ohlemacher discusses in the Bloomsberg Businessweek.

Ways to reduce invoice follow-up stress. Watch for new customers with a bad credit history. Some of the tips to decrease the overdue in business are discussed below.

Calls from the accounting department or sales might be made depending on the connection with each client. Knowing them means that you know the cost of each of your raw materials labor rent or lease costs and everything else. Your policy does however have to be clear about when you are willing to give credit how much and who to as well as when exactly you will consider a payment to be overdue.

Review your business budget. Offer an incentive for. Ways to Reduce Overhead Costs in Business Record Keeping.

One day past due send an e-mail reminder. The best way to prevent overdue invoices is to not let them happen. Ask for deposits upfront and staged payments.

One way to reduce stress is by automating the email follow up process. Make sure the incentives you give to your sales team take credit into account. 15 days past due make a friendly call to the client.

Chasing unpaid invoices can be stressful and lead you down serious legal avenues. For example you can prioritize suppliers with late payment penalties or early payment discounts to make sure that their invoices are paid quickly. A typical discount is two percent to three percent off the total if.

There are a few ways to prevent it. Offering discounts for early payment is a great incentive for many customers and a large percentage will take advantage of the discounts. The most important thing is to stick to this policys.

You should also monitor the customers progress to make certain they comply with the agreement and are not on the verge of bankruptcy. Sometimes late payments are as a result of work overload.

How To Keep On Top Of Cash Flow And Manage Overdue Invoices Accountsportal

Pdf Google Docs Apple Pages Free Premium Templates Letter Templates Collection Letter Business Letter Template

Collection Letters To Customers Beautiful Friendly Collection Letter Overdue Balance Collection Letter Simple Cover Letter Template Cover Letter Template Free

Accounts Receivable Ax 2012 Accounts Receivable Excel Spreadsheets Templates Purchase Order Template

Accounts Receivable Dashboard Excel Dashboard Templates Dashboard Template Microsoft Excel Tutorial

Word Google Docs Pages Free Premium Templates Letter Templates Lettering Letter Addressing

Raise Your Credit Score 50 Points Fast Step By Step Entrepreneur Credit Score Scores Credits

Stop Wasting Time And Automate Customer Payments Reminders With Upflow Businesses Quickly Collect Unp In 2021 How To Find Out Accounts Receivable Client Relationship

Upflow Accounts Receivable Automation Software For Teams Accounts Receivable Accounting Client Relationship

Supply Chain Management Canvas Strategok By Javier Gonzalez Chain Management Warehouse Management Supply Chain Management

Pdf Google Docs Apple Pages Free Premium Templates Invoice Template Word Business Letter Template Lettering

Business Dashboard Template Accounts Payable Business Dashboard Accounts Payable Dashboard Template

How To Minimize Debt In Business 6 Steps To Follow

Managing Your Accounts Receivable Accounts Receivable Small Business Advice Accounting

Payment Outstanding Reminder Letter Invoice Reminder Template Invoice Reminder Template Tips And Plans If You Lettering Collection Letter Job Cover Letter

Comments

Post a Comment